We’ve shown you the ways that COVID-19 has changed general consumer behavior and how businesses started to adapt to it. Now, we wanted to take a deeper look into how specific industries were affected, how their content strategies interactions between their followers and brands have changed.

By compiling social data from Instagram, we were able to analyze multiple accounts belonging to industries that were especially affected by the Coronavirus, specifically beauty salons and fitness centers. We have another pair of industries to analyze, specifically food delivery apps and fast-food restaurants, so make sure to be on the lookout for those findings in the next week.

Keep reading to see what we found about these two industries. 😉

Why did we conduct this analysis?

Part of the inspiration came from Sotrender’s Audience Interest analysis, as we found that certain industries were becoming more interesting for Facebook audiences. The analysis showed that suddenly, more Facebook users were becoming interested in specific topics, and when compared to eCommerce statistics, patterns emerged.

Since consumers couldn’t go to the places they regularly visited, we were curious about how these businesses were going to maintain contact with their customers. Whether you’re a content marketer, a social media analyst, or a brand representative, there’s definitely something in our analyses that could surprise you. If you’re interested in content marketing or how users interacted with brands when they were spending more time online, this post should answer those questions.

To start, we wanted to answer the following questions:

- Did the industries differ when it came to types of posts they published?

- Which industries had more engagement overall and per month? And was this reflected in the relationship between the number of likes and comments?

- What hashtags emerged during the two-month lockdown period?

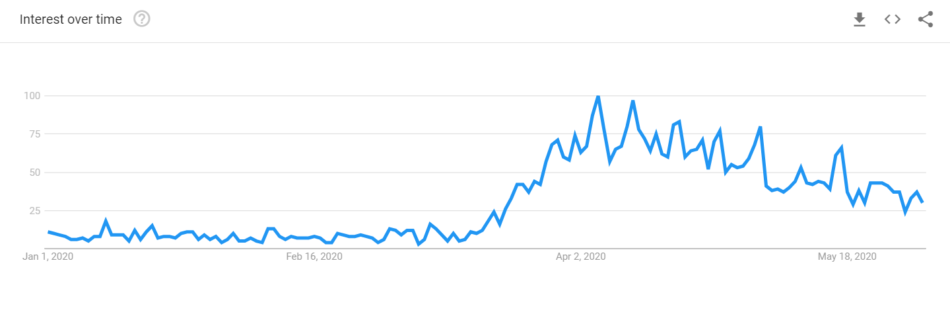

What’s more, Google Trends showed that there was an increase in searches similar to “home workouts” and “how to cut your own hair”. Based on Google Trends and other marketing blog posts, it seemed that some industries would be more relevant for analysis.

Actually, how we decided which brands to include in our analysis was rather subjective. We searched terms such as “Top fitness centers in the US/UK”, and selected those that had business accounts on Instagram.

The data that we’ve gathered and analyzed will illustrate some of the ways that content strategies and consumer reactions have changed over time before and after the lockdown. Just to clarify, we organized our data as before the lockdown (January and February), during lockdown (March and April), and after lockdown (May and June). We gathered the data by using Instagram’s API.

We’ll go over some of the general patterns and results we’ve observed starting from January to June to see what happened to some of the best rated Instagram profiles within their industries.

The beauty salon industry

According to Statista, beauty salons made over 128 billion USD worldwide in 2017, and they’re projected to make just over 190 billion in 2024. As you can probably guess, beauty salons are a popular and lucrative industry. However, because of the lockdown, all salons were expected to shut down to prevent spread via close contact. Although this was a logical preventative measure, it also hurt several businesses for months at a time.

We thought that this industry would be perfect to analyze from a social media perspective, so we can see how popular salons can try to stay relevant with their fans even when they’re away for so long.

We included the following salons in this category:

- Whiteroom Brooklyn (U.S.)

- Nine Zero One (U.S.)

- Hershesons (UK)

What kind of posts did salons upload?

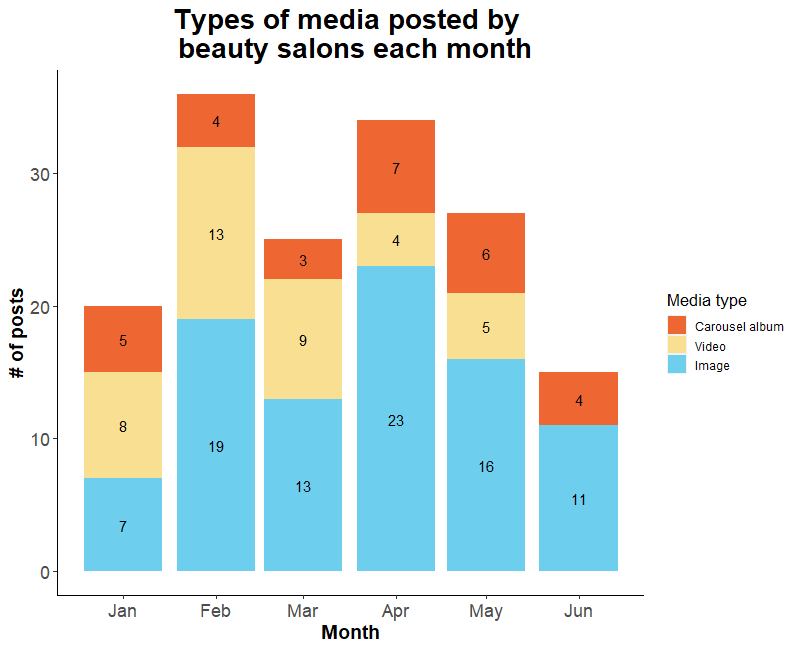

It’s not surprising that video and carousel posts aren’t as common since they require more time and effort to create. However, we know that video content can be efficient at creating a sales pipeline for your brand and that users engage more with videos, so it’s definitely worth it to post video content when you can. And on that note, we’ll now take a look at engagement on all the chosen profiles.

It’s worth pointing out once again: we gathered the data directly from Instagram’s API, so some posts could have been omitted.

For salons, there was more diversity in the type of content they posted. This is partially because they post a great deal of videos where they showcase their “transformations” (example below).

Carousel albums were used for the same purpose, though. What’s more, the videos are helpful because some of them have their own products so they can show their clients how to use them.

In general, beauty salons rely on all three types of posts since they can really show off the difference before and after a client visited them.

How many comments did they get over time?

The point of comparing how many comments a brand got over time is to understand which content appealed to their audience. It’s possible that you were posting more related to one theme or style, and they were more interested in that. Alternatively, it could be the fact that most of us had to stay at home for longer periods of time. 🙂

The gist of it is, the more comments you get, the more likely it is that your followers like what you’re posting, and they’re interested in your product/service.

As you can see, there was an increase in comments at the very beginning of the lockdown. Around this time, we could see followers left more comments than before or after. It’s likely that they wanted to show support to their favorite salons.

What’s more, there was a sharp increase in comments for both Nine Zero One and Hershesons. Whiteroom generally had fewer comments, though they did start to slowly pick up around May and June. This might be because Whiteroom took a break in April from posting, and came back with a post letting their audience know that they miss them and that they’ll give them updates when restrictions are lifted in New York City.

It’s worth bearing in mind that Hershesons has around 45k followers, Whiteroom has around 10k, and Nine Zero One has over 260k. So in that way, it’s not surprising that Whiteroom has fewer comments than the others.

What hashtags did the beauty salons use?

We know that hashtags are one of the crucial components for a successful social media post on Twitter and Instagram. Without them, it’s hard to gather the organic reach you’re hoping for. So what hashtags did they use? How many of those hashtags ended up being used more often as a direct result of the lockdown?

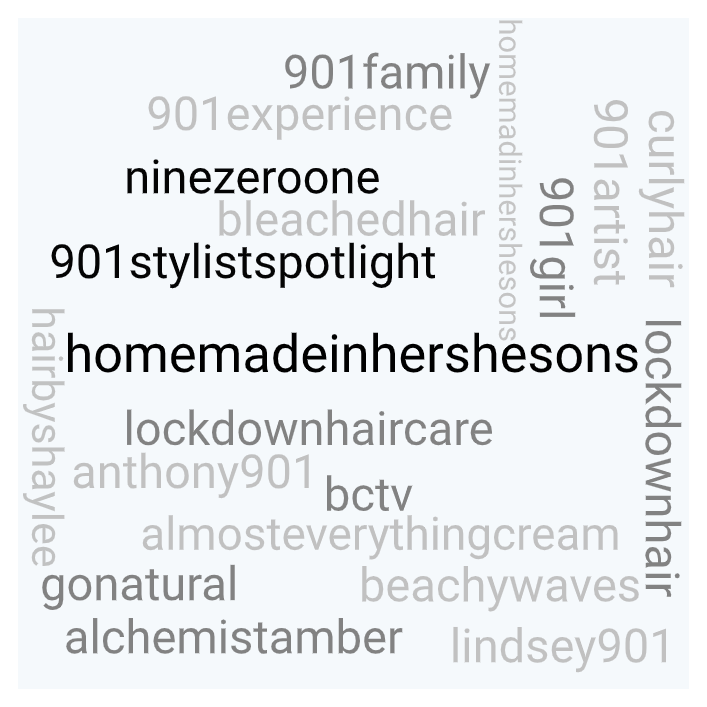

You might be familiar with personal branding, but here’s something to refresh your memory: one of the ways you can keep track of user-generated content is to have a recognizable hashtag. It makes it much easier for your followers to interact with your brand.

One of the things you’ll notice is that there are some rather large hashtags or hashtags that are repeatedly used over time. Why might these brands choose to repeatedly use the same hashtags they’ve used before? We suspect that it may be because these are fairly popular hashtags, and they have stayed popular before Coronavirus, and they will stay relevant after. The general rule is that you can use more popular hashtags if you have high engagement, but if your engagement is low, stick to the less popular hashtags.

We can see the ways that beauty salons used their own hashtags. Most of the popular ones are related to the specific salons like #homemadeinhershesons or #901girl, though they did reference the lockdown a few times. They used #lockdownhaircare and #lockdownhair, which are still being used on Instagram to show off before and after pictures, as well as users relating to one another with their lockdown bad hair days.

One last thing to point out is that many of the hashtags come from the Nine Zero One salon. One of the benefits of having their brand-specific hashtags specifying whether the post is about a client (#901girl) or about their stylists (#901artist) is that it will allow them to stay organized and track which hashtags are regularly getting them better reach and engagement.

Examples of posts

For some businesses, increasing or maintaining the amount of posts could have been a good idea. The reasoning behind this is that by posting regular and relevant content, their customers wouldn’t forget about them so easily. What’s more, the customers will still benefit from the business, as businesses could offer help, tutorials, or guides over social media for free. For example, beauty salons had hair stylists explaining how their customers could take care of their hair at home while they couldn’t schedule appointments.

Earlier on, we mentioned that Whiteroom Brooklyn uploaded a post about how they miss their audience and that they were waiting for news about when the restrictions would be lifted. Although there were a few comments, they were all positive towards the salon.

They also had a good sense of humor about it and posted memes about how they would fix all of the bad at-home hairstyles.

Conclusion

The beauty salons that we analyzed definitely experienced a jump in the amount of attention they were getting during the lockdown. They adjusted their strategy to include useful content that was relevant to the time frame, and in turn, got more comments in the same time frame. Their hashtag strategy generally includes salon-specific hashtags and a few references to the lockdown. Overall, they did the best they could to keep their audience entertained, informed, and to remind them that they’ll be back soon.

The fitness center industry

There are more than 180,000 fitness centers around the world, with 34,000 in the U.S. alone. Obviously, it’s considered to be a lucrative industry. It also tends to have a net positive impact on the general public, both for health and entertainment purposes. We were sad to see it disappear for those months during the lockdown.

Like the beauty salon industry, customers need to actually visit the location to benefit from its services. And like beauty salons, the fitness centers adapted their strategy in a way that helped their clients, but also helped them stay relevant during the lockdown.

We included the following fitness centers in this category:

- Planet Fitness

- Anytime Fitness

- Snap Fitness

In general, we did find some differences between the fitness centers we analyzed and the salons, but you’ll have to keep reading to find out. 😉

What kind of posts did fitness centers upload?

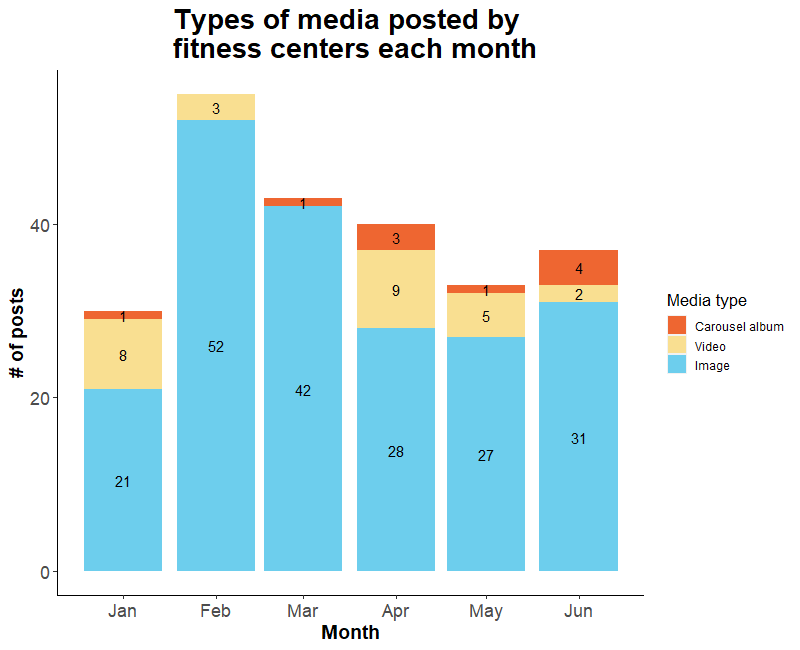

As it turns out, these fitness centers rarely posted anything other than image posts. They had the least videos and carousel albums. There were drastically more image posts in February and March than the other months, including memes and notifications about home workout events. Some of the videos posted from April included short clips of workout challenges.

Posting video content might not make sense unless they’re using IGTV because workouts are longer than the regular limit for a post on Instagram. Also, there were some “transformation” posts that were meant to be motivational. Usually, the person pictured had both images side-by-side in one frame, though (unlike salons).

How many comments did they get over time?

Once again, a similar set of spikes occurred for the fitness centers. They ended up getting an increase in comments around March. However, they had even more around May and June, when the restrictions were being lifted. The main difference between the two industries is that in April, all of the fitness centers we analyzed had very few comments.

What hashtags did the fitness centers use?

The fitness industry generally kept using the same hashtags that they always have. The most popular one was #snapnation, suggesting that Snap Fitness followers see this one rather often. Although, some lockdown hashtags were popular, like #workoutfromhome and #athome. This suggests that even at the height of the pandemic, gyms didn’t change much in their hashtag strategy.

For example, Anytime Fitness didn’t reference the coronavirus in their posts. However, Snap Fitness posted about the virus in a few different ways. They shared posts about ways that you can workout from home without your regular gym equipment, free online fitness classes that you can attend, and some humorous posts about home fitness.

Examples of posts

Much like the beauty salons, the fitness centers adjusted their content to include some lighthearted humor and guides. We’ve included examples from every gym to show you the different kinds of content you could come across while scrolling their feeds.

Snap Fitness decided to share a type of “tag yourself” post which can easily get a lot of engagement. Their followers got to specify to others in the comment section what type of workouts they would prefer to do. It can also provide Snap Fitness with more info about what equipment their customers want to see more of (and they can make it happen).

As for the guides, Anytime Fitness included a playlist of at home exercises in their Instagram bio. They showed off some of the ways that you can use household items or space to exercise without the risk of infection. So instead of their members having to invest in expensive exercise equipment, they could save the time and money by just using what they have. 😉

Finally, we see that Planet Fitness was promoting their Home Work-Ins. Sometimes they shared images of their members exercising with a trainer through Facebook Live. Alternatively, they shared carousel albums promoting a specific trainer’s workouts. Both of these forms can get a lot of attention from their followers.

Conclusion

The fitness centers we analyzed didn’t have a diverse set of formats their posts were in. They had the most image posts, but the images they shared varied in content. Instead of uploading all of their guides on IGTV like the salons, they shared their Facebook Live streams. Like the salons, they did use their brand-specific hashtags, but they also used larger, more popular hashtags. Finally, their engagement types were related and their followers commented more than usual during certain stages of the lockdown (when it was being enforced and restrictions were being lifted).

Wrapping up

It’s pretty clear at this point that the two industries had some shared patterns. They posted content with similar goals, though they differed in the formats they posted it in. The two industries were interested in interacting with their audience and not being easily forgotten during the lockdown.

We hope that you found the results as interesting as we did, though we definitely acknowledge that there’s the possibility to dive deeper into the data. As a company primarily interested in social media data, we’re going to continue to analyze the ways in which brands and users behave and interact online.

Do you have any profiles you would be interested in having us analyze? Are you interested in any particular industries and time periods? Let us know in the comments or via email, and we will draw inspiration for our future posts. 😉